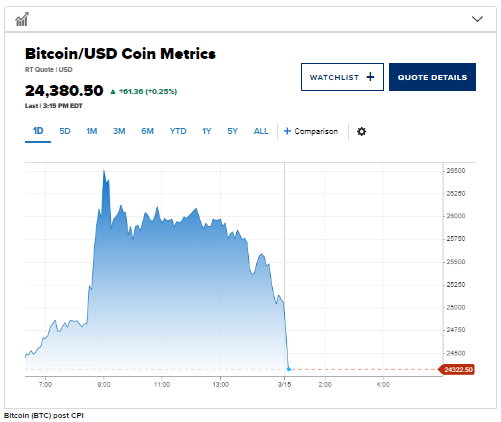

由于投资者权衡最新的通胀数据,比特币周二跃升至去年夏天以来的最高水平,延续了周一的涨势。

Bitcoin rose about 4% to $25,483.70, according to Coin Metrics. Chart analysts had been eyeing $25,200 as a key level to watch. Earlier in the day it rose to $26,513.27, its highest level since June 13, just before its pre-FTX bottom.

醚 added 3% to trade at $1,747.87. In traded as high as $1,783.07, a level not seen since Sept. 12, during the rally that preceded the Ethereum merge.

Prices jumped initially following the latest consumer price index reading, but have pulled back since. Still, bitcoin is now up about more than 24% since Friday, when regulators shut down Silicon Valley Bank, and 54% for 2023. Ether has gained 20% since Friday and 45% year-to-date.

The CPI data showed an increase of 0.4% in February from January, matching the consensus estimate of economists polled by Dow Jones. So-called core CPI, which removes volatile food and energy prices, showed a monthly increase slightly above economists’ expectations, and a year-over-year change in line with expectations.

“CPI data today is in-line with consensus. Together with the banking crisis, the market believes that the Fed will pause rated earlier than before and the terminal rate will be lower than previously thought,” said Owen Lau, an analyst at Oppenheimer. “The likelihood of a rate cut this year has also increased.”

Cryptocurrency prices have recovered dramatically since late last week, with market sentiment flipping 180 degrees after U.S. regulators backstopped the depositors of Silicon Valley Bank and Signature Bank. This led some investors to speculate that the Fed would be less aggressive in raising interest rates.

Bitcoin’s correlation with the Nasdaq is at its lowest level since the early November collapse of FTX, according to crypto data provider Kaiko. Its price is still largely driven by macro data and some analysts expect to see a bigger return to that correlation, even with idiosyncratic events driving much of the action in 2023.