Bitcoin probes key resistance amid positive macro developments and a slowdown in miner selling. (TradingView)

Risk assets seem to be breaking out bullishly, with bitcoin challenging its 100-day simple moving average (SMA) that aborted the August rally.

The resistance at $20,882 could be convincingly toppled this time, as prominent traders think the latest market bounce is more long-lasting than the one seen two months ago.

“It’s a bit more constructive than August, as we’re more removed from the 三箭资本 和 Celsius [Network] 和 Terra events, and many more bitcoin miners have liquidated their position,” Shiliang Tang, chief investment officer at crypto hedge fund LedgerPrime, said.

“So supply overhang in BTC should be less, and firms a bit more comfortable redeploying capital now that the dust has settled, and the [Federal Reserve] has gotten a few [interest rate] raises out of the way since,” Tang added.

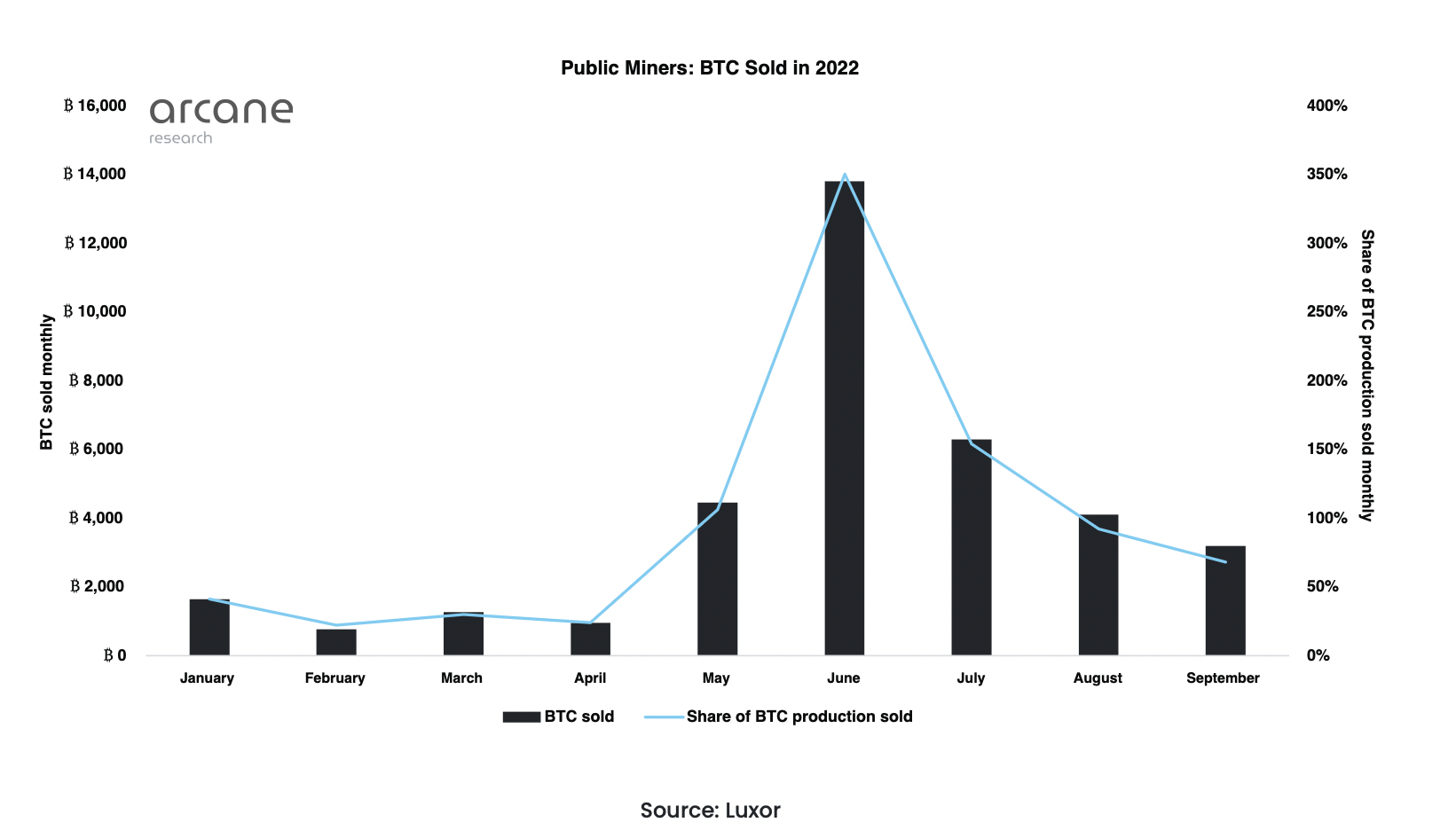

Miner selling has slowed since June. (Arcane Research, Luxor)

The chart from Arcane Research and Luxor shows public miners have slowed their coin sales since June when they ran down their bitcoin inventory by liquidating 350% of the mined coins.

Last month, miners liquidated only 68% of the coins produced, weakening the sell-side pressure in the market.

The market no longer seems hungover from the collapse of Terra’s, Three Arrows Capital, and crypto lender Celsius as it was three months ago and grown resilient to negative headlines. Bitcoin remained flat early this month despite reports that U.S. federal agencies are probing Three Arrows for various possible legal violations.

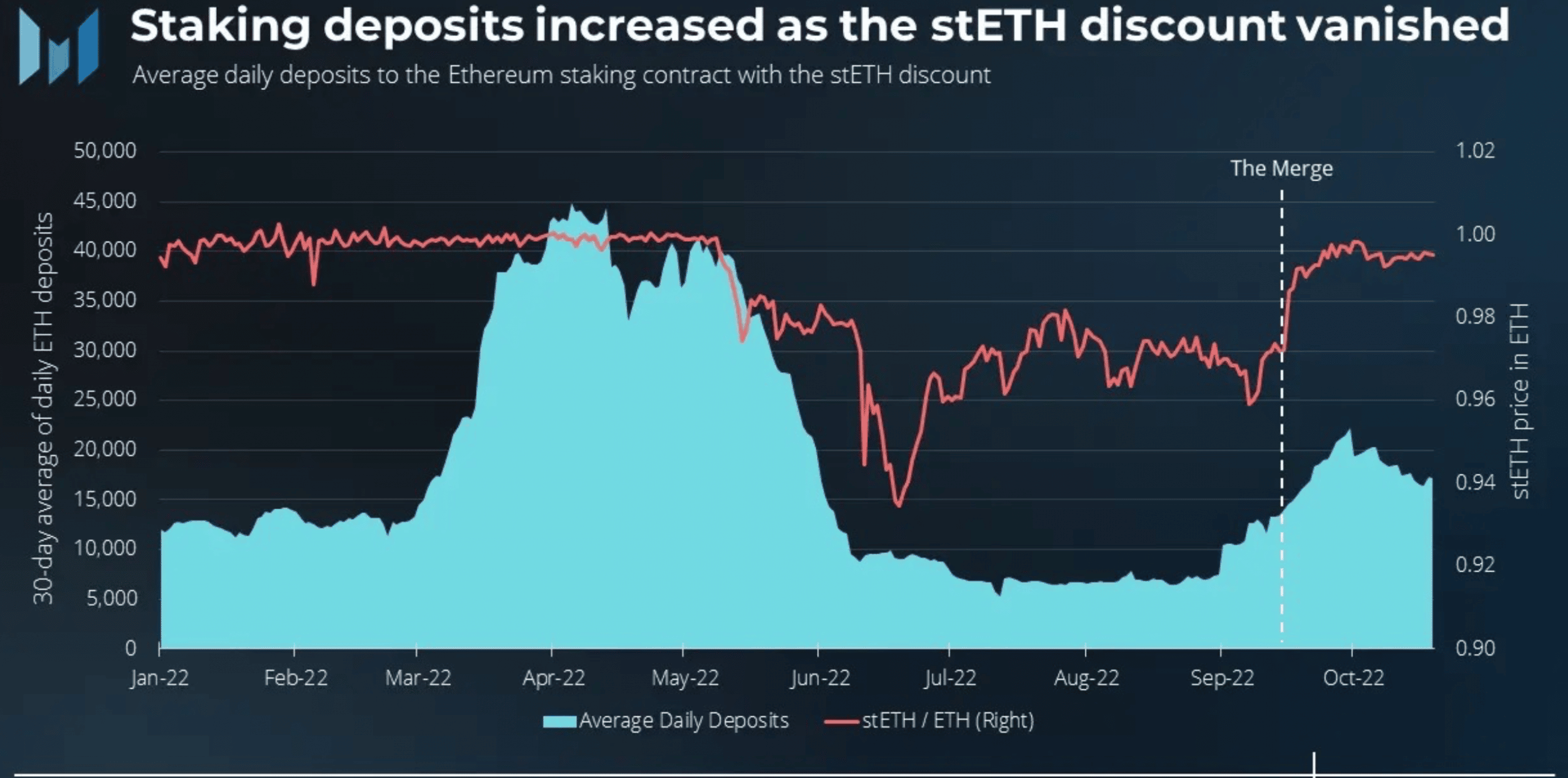

The discount in the staked ether (stETH) token has vanished. (Messari) (Messari)

Liquid staking protocol Lido’s staked ether (stETH) token has recently caught up with ether’s spot price, erasing the discount in another sign that gloomy summer days are behind us.

Besides, the latest crypto market bounce comes on the back of material evidence that the Federal Reserve may be close to slowing the pace of liquidity tightening as opposed to early August when equity and crypto markets ran ahead of themselves in pricing the so-called Fed pivot.

Last week, San Francisco Fed President Mary Daly said the central bank should avoid pushing the economy into an “unforced downturn by raising rates too sharply. Daly added that it’s time to start discussing slowing the pace of tightening. Wall Street Journal reporter Nick Timiraos published an article last Friday hinting the Fed could slow the pace of rate hikes to 50 basis points in December.

The bond market seems to be in agreement with the crypto market. The U.S. Treasury yields, which remained elevated in August, contradicting the Fed pivot hopes in crypto and equity markets, have dropped sharply this week, confirming the bounce in risk assets. The 10-year yield has declined by 30 basis points to 4% since Friday and the two-year yield, which is more sensitive to rate hike expectations, has dropped by 20 basis points to 4.43%.

“Markets have leaned optimistic for most of the year, only to be served a reality check by monthly economic data prints fueling continued Fed hawkishness. However, tides are potentially slowly starting to turn, with the Fed hinting at a potential slowing of rate hikes, not an outright pivot,” Josh Olszweicz, head of research at digital asset fund manager Valkyrie Investments told CoinDesk, noting the weakness in yields and the dollar index.

“Markets have leaned optimistic for most of the year, only to be served a reality check by monthly economic data prints fueling continued Fed hawkishness. However, tides are potentially slowly starting to turn, with the Fed hinting at a potential slowing of rate hikes, not an outright pivot,” Josh Olszweicz, head of research at digital asset fund manager Valkyrie Investments told CoinDesk, noting the weakness in yields and the dollar index.

Wes Hansen, director of trading and operations at crypto fund Arca, said, “The news out Friday that the Fed was likely to begin easing up on the rate hikes, along with the growing chorus of investors, politicians and international agencies to do this, has led to a changing macro picture for the markets.”

“I would find it hard to justify that this is the end to the bear market, but there were some real market changes that led to this rally,” Hansen noted, adding that the scenario where inflation cools, allowing the Fed to pivot could be near.

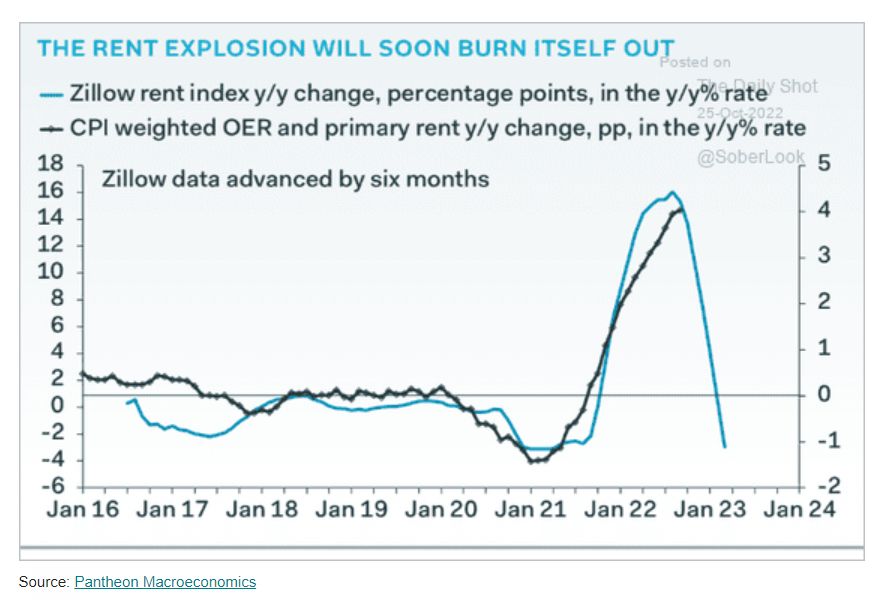

The data advanced by six months shows rent explosion could soon fizzle out. (Pantheon Macroeconomics, Geo Chen) (Pantheon Macroeconomics, Geo Chen)

Data from Pantheon Macroeconomics and macro trader Geo Chen’s substack post shows that shelter inflation, the largest component of the U.S. consumer price index, could soon turn from a headwind to a drag on headline inflation.

“A dramatically declining CPI will provide evidence for a less hawkish Fed going forward. Any signs of slowing the pace of hikes will likely be seen as incredibly bullish by risk-on market participants,” Valkyrie’s Olszewicz said.

The Fed is widely expected to deliver its fourth consecutive 75 basis point interest rate hike on Nov. 2, lifting the benchmark interest rate to the 3.75%-4% range.

The U.S. third quarter GDP, due later Thursday, the core personal consumption expenditure scheduled for release on Friday, and the Nov. 10 CPI reading could influence Fed expectations and bring volatility to asset markets.