Three Arrows Capital plunged deeper into financial turmoil Wednesday after a court in the British Virgin Islands ordered the crypto-focused hedge fund into liquidation following its failure to repay creditors as the value of bitcoin and other cryptocurrencies have nosedived.

The liquidation order comes after a high-profile notice of default: On Monday, crypto broker Voyager Digital announced that Three Arrows Capital had not made the required payments on a loan worth more than $665 million, paid partly in bitcoin.

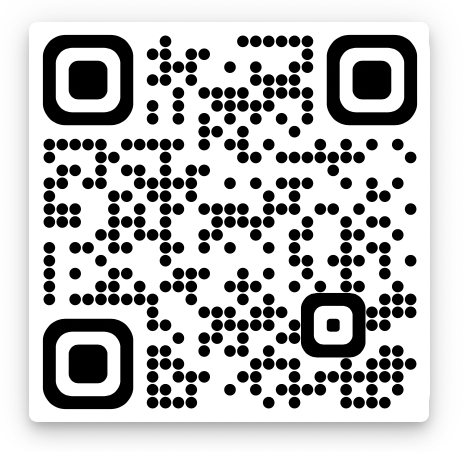

Two senior members of the global advisory firm Teneo have been appointed by the court to help manage the liquidation, according to a person familiar with the matter who spoke on the condition on anonymity because they were not authorized to publicly discuss the process. In coming days, Teneo will have a website that will allow potential creditors of Three Arrows Capital to submit claims and receive more information about the insolvency, the person said.

Crypto hedge fund Three Arrows Capital in default on $665 million loan

Teneo and Three Arrows Capital did not immediately respond to a request for comment.

The escalating financial turbulence marks the latest setback for the crypto industry. Faced with collapsed token prices, abrupt layoffs, emboldened critics and a high-inflation economy that has compelled the Federal Reserve to aggressively raise interest rates, the sector is in the grips of a harsh “crypto winter.”

Sky News first reported news of the liquidation order Wednesday.

Three Arrows Capital was created in 2012 by Su Zhu and Kyle Davies, and is known for its bullish moves on crypto. But signs of trouble emerged in May when Su admitted publicly that his thesis about escalating crypto prices was “regrettably wrong.” Then, in a cryptic tweet earlier this month, he said that, “We are in the process of communicating with relevant parties and fully committed to working this out,” without offering relevant details. Days later, the Financial Times reported that Three Arrows Capital had failed to meet demands from lenders to show extra funds after its wagers on crypto had gone bust.

Before the crypto markets took their most recent tumble, the firm claimed about $3 billion in assets under management, Davies told the Wall Street Journal earlier this month.

The industry’s high level of interconnectedness also has raised alarm bells. Many companies borrow from and invest in one another, amplifying the risks to investors because a potential failure at one crypto firm could force others to collapse.

Crypto investors in recent months have endured breathtaking losses. Bitcoin, the most prominent cryptocurrency, has been hovering near $20,000 — briefly falling below that threshold on Wednesday — and has shed more than two-thirds of its value since peaking near $69,000 in November. And while the total market for all cryptocurrency stood near $3 trillion last year, it has since cratered to below $1 trillion.

The staggering losses have drawn the attention of political leaders and regulators, who have raised concerns about the lack of financial oversight and investor protections in the sector. Earlier this month, the Celsius Network, a cryptocurrency bank, began to halt withdrawals by its nearly 2 million depositors because of what it called “extreme market conditions.” Since then, securities regulators in at least five states have launched investigations into the bank’s operations.

The crypto world’s sharp downturn coincides with a souring mood on Wall Street, where the S&P 500 has shed about 20 percent of its value this year and many observers are bracing for a potential recession. Investors, adjusting to the aggressive moves of the Fed to cool the economy, are fleeing more speculative assets for safer bets. Historically high inflation and the war in Ukraine are also squeezing consumers and global supply chains, all adding up to a rougher economic environment, in sharp contrast to the exuberance that launched cryptocurrencies and the legacy financial markets to new highs last year.