JP모건 애널리스트들은 FTX 붕괴로 투자자들이 주요 암호화폐 거래소에서 자금을 빼내고 있다고 말했다.

In a note to investors Wednesday, analysts at the investment bank noted that all major exchanges experienced outflows last week but Gemini, OKX and Crypto.com had the most “severe” draining of funds.

Analysts also said that the stablecoin market is getting smaller—and this may continue to hurt the price of other major cryptocurrencies like Bitcoin.

FTX was one of the most popular digital asset exchanges but last week imploded—losing billions of dollars of investors’ cash. The exchange and its related entities crashed because FTX was using money from the exchange to make bets through trading firm Alameda Research, also founded by the exchange’s CEO Sam Bankman-Fried.

After a leaked document revealed Alameda’s holdings were primarily in the FTX-issued token FTT and other highly illiquid assets, rival exchange Binance announced it would sell off its entire FTT stash—leading to a bank run and eventually causing a liquidity crisis which collapsed FTX.

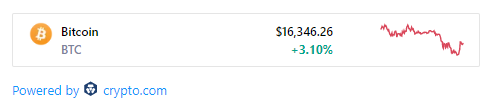

The fall of the exchange sent shockwaves through the crypto market, sending prices of major coins and tokens plunging. Bitcoin, the largest cryptocurrency by market cap, hit a two-year low following the fallout.

“We had argued last week that, similar to what we saw after the collapse of TerraUSD last May, the current deleveraging phase that started with the collapse of Alameda Research and FTX is likely to reverberate for at least a few weeks inducing a cascade of margin calls, deleveraging and crypto company/platform failures,” JPMorgan’s analysts wrote, referring to the collapse earlier this year of crypto project Terra, which also lost billions of dollars of investors’ cash.

“Deleveraging,” in this case, is when investors or companies reduce the debt they previously took on to make investments in the crypto sphere. Most market analysts agree that only after the bad debt is flushed out will the crypto market reach its bottom and potentially recover.

Analysts added that unless the stablecoin market doesn’t stop shrinking, the market will struggle to recover. “It would be difficult here to imagine a sustained recovery in crypto prices without the shrinkage of the stablecoin universe stopping,” the note read.

Stablecoins are a type of cryptocurrency pegged to another asset, like dollars or gold. They are designed to be stable, unlike Bitcoin or other digital assets which are volatile.

These digital assets are often used by crypto traders to quickly enter and exit positions in other coins or tokens without the need to convert to a fiat currency—like U.S. dollars—and they are considered to be the backbone of the crypto market.

JPMorgan said that the market cap of largest stablecoins peaked at $186 billion in May before Terra’s collapse but has been declining since then—with $25 billion being chased out via stablecoin redemptions.

부인 성명

저자가 표현한 견해와 의견은 정보 제공의 목적일 뿐이며 재정, 투자 또는 기타 조언을 구성하지 않습니다.