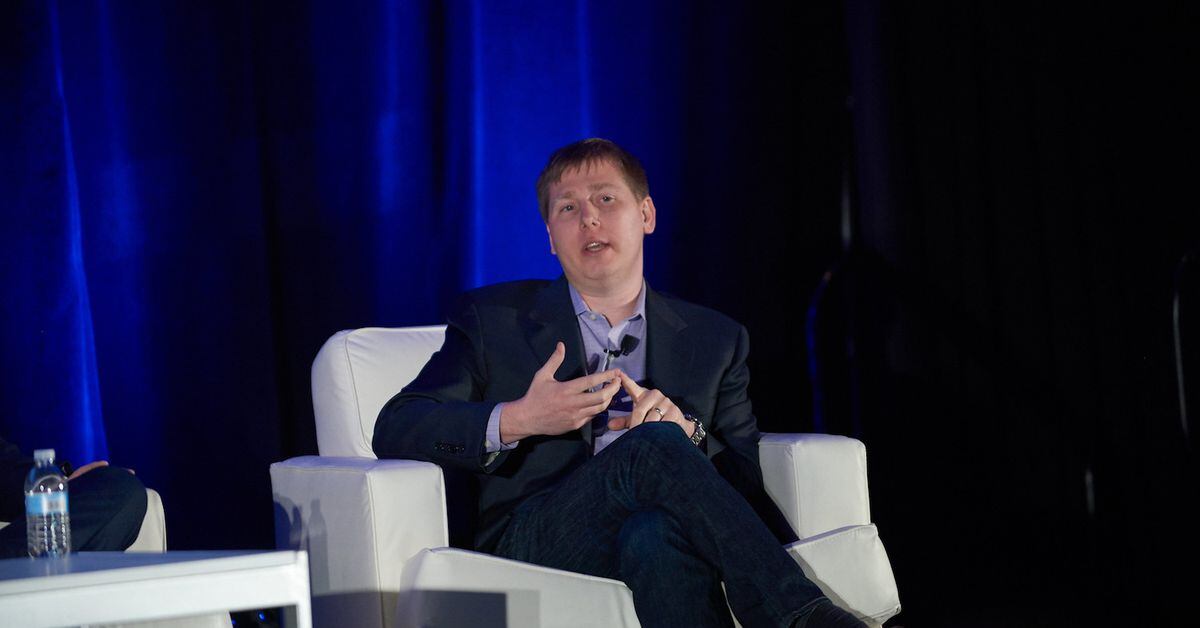

DCG founder and CEO Barry Silbert (CoinDesk archives)

Officials with the U.S. Department of Justice’s Eastern District of New York (EDNY) and the U.S. Securities and Exchange Commission are examining transfers between Digital Currency Group and the conglomerate’s Genesis subsidiary, Bloomberg reported late Friday.

The prosecutors with the DOJ’s Eastern District of New York office have requested interviews and documents from DCG and Genesis, the report said, while the SEC appears to be in a similarly early stage of its own inquiry. The report, which cited people familiar with the matter, said that neither Genesis nor DCG, which is also the parent company to CoinDesk, have “been accused of wrongdoing.”

The inquiries seems specifically focused on the financial interplay between Genesis and DCG, according to the report.

CoinDesk reported in late June that Genesis Trading was facing major losses due to loans made to the now-imploded hedge fund Three Arrows Capital, later filing a claim for $1.2 billion. DCG assumed the claim for Genesis.

In November, Genesis announced that its lending unit would suspend withdrawals, which had knock-on effects against companies like Gemini, which relied on Genesis for its Earn platform. Gemini co-founder Cameron Winklevoss and DCG founder Barry Silbert have since begun publicly feuding over issues arising from this suspension. Genesis has also undertaken major layoffs in the past few months, replacing its executive leadership and nearly halving its headcount since August. The subsequent implosion of crypto empire FTX further damaged Genesis’s books.

Genesis has also tapped advisers to explore options, which could potentially include a Chapter 11 bankruptcy filing.

As of early December, Genesis creditors had made claims totaling upward of $1.8 billion, CoinDesk reported at the time.

Separately, another DCG subsidiary, Grayscale, is facing issues with its key bitcoin trust product. A discount in the price of a share of the trust relative to the price of bitcoin broke 50% last month, indicating a lack of trust in the product or in investors’ ability to cash out of it.

A DCG spokesperson told CoinDesk Saturday morning that “DCG has a strong culture of integrity and has always conducted its business lawfully. We have no knowledge of or reason to believe that there is any Eastern District of New York investigation into DCG.”

A spokesperson for Genesis did not immediately return a CoinDesk request for comment. Bloomberg quoted a Genesis spokesperson as saying it “maintains regular dialogue” with regulators but couldn’t comment on any specific issues.

UPDATED Jan. 7, 2023 17:30 UTC: Adds DCG spokesperson’s comments.